The Future of Consumer Preferences: High Standards

In our Consumer Behaviour Survey, we conducted a profound analysis in order to evaluate the parameters shaping consumer trust, expectations from brands and consumer experience, in addition to awareness, attitudes & behaviours regarding sustainability within the Turkish economic landscape that is driven by local and global dynamics.

Key findings

The Consumer Trust and The Economy

The conventional economic policies put into effect following the presidential election and the solid steps regarding price and financial stability, was reflected as a decrease in risk perception.

The determined attitude shown in the policies has resulted as a more positive outlook in consumers' perspective on the economy compared to last year. According to the survey results, while 71% of the participants described their expectations for the economy as bad or very bad previous year, this ratio decreased to 57% this year. Also, while 10% of the participants evaluated the economy as very positive, this year this rate was measured as 15%.

Consumer Expectations and The Next Steps

Why do consumers prefer online shopping channels?

Online shopping has been an important part of our lives for a long time. The frequency regarding the consumers' usage of online shopping channels has increased compared to last year. The reasons for preferring online shopping are convenience of price comparison and shopping, price advantage, product range and fast shopping opportunity, consistent with the previous survey results.

The importance of online shopping, supported by product evaluations and user comments, increases constantly with customized recommendations, campaigns and experiences, besides offering a more conscious and secure shopping experience.

Cross border online shopping channels

Cross border online shopping has increased compared to the previous survey findings. The ratio of cross border online shopping increased to 58% in 2023 from 43% in 2022. The average usage frequency was 2.6 times a month in 2022 which increased to 4 times a month in 2023. 3 key issues stand out as underlying factors.

- Price advantage: Cross border prices offer more advantage compared to domestic prices though they are in terms of foreign currency.

- Product range: Cross border suppliers provide a more diversified product range.

- Warranty / local service opportunities: Although some products do not offer warranty and service opportunities, it doesn't affect cross border channel preference.

Engagement with The Consumer

Data-driven communication with consumers increases its importance.

The top reasons for consumers preferring stores are seeing and examining the product in the store, the convenience of the store location, offering a personal shopping experience, and liking the social aspects of going to the store.

On the other hand, the majority of consumers gather product information from both stores and online sources. Consequently, they may prefer to examine products in certain categories in the store and then purchase them from online platforms.

Internet news and social media have a major influence on purchasing decisions besides family and friends. Campaign and discount announcements on social media make the shopping experience more attractive by offering instant access and lead impulse purchasing decisions.

The Consumer and The Sustainability

Shopping preferences are no longer limited to personal satisfaction, but also aim to protect natural resources, reduce environmental impact and support fair trade practices. This awareness process changes market dynamics by driving brands as well as consumers to more responsible and environmentally friendly practices, thus creating a more sustainable consumption culture.

Sustainable products, including elements such as renewable energy, recycled materials, and fair trade practices, allow consumers to make more conscious preferences thus reducing environmental impacts.

This awareness process changes market dynamics by leading brands as well as consumers to more responsible and environmentally friendly practices, and building up a more sustainable consumption culture.

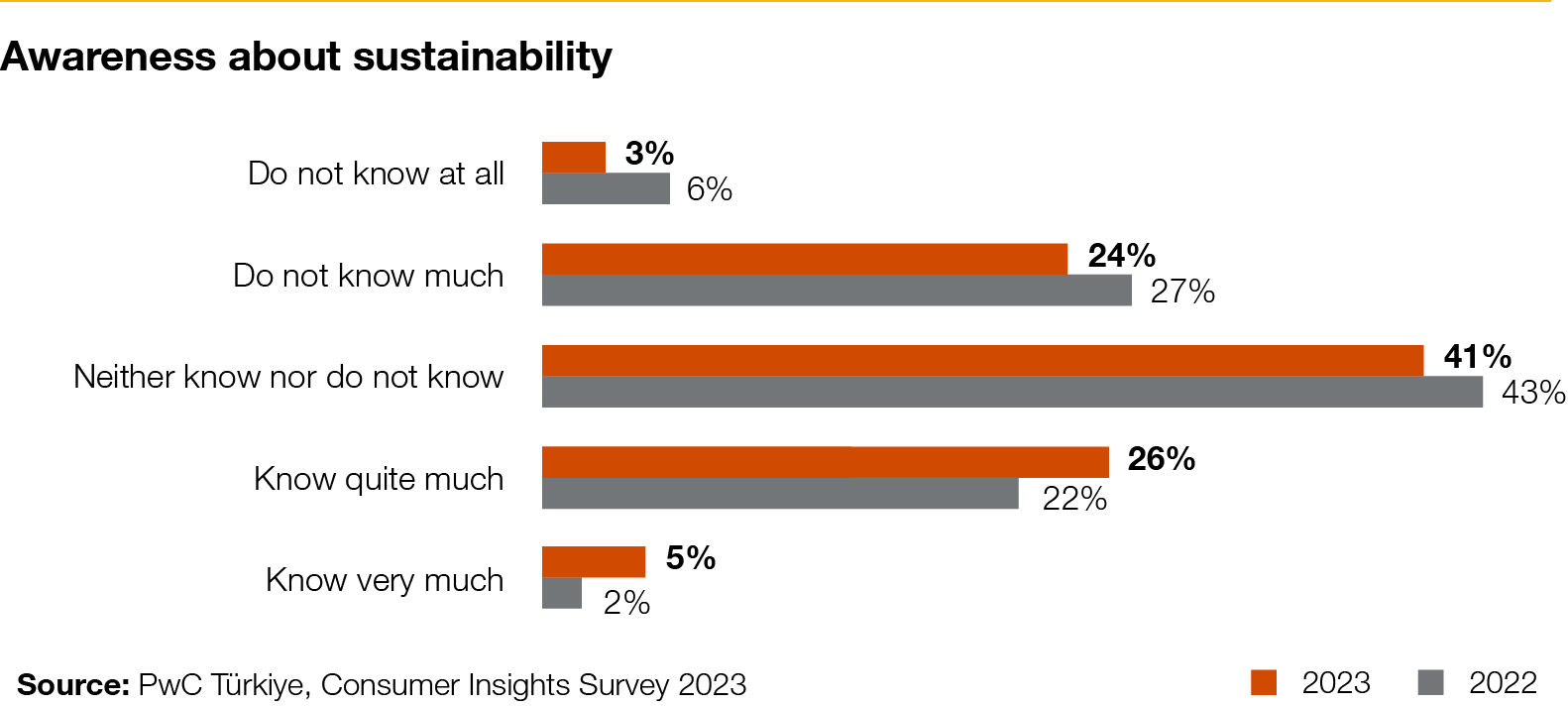

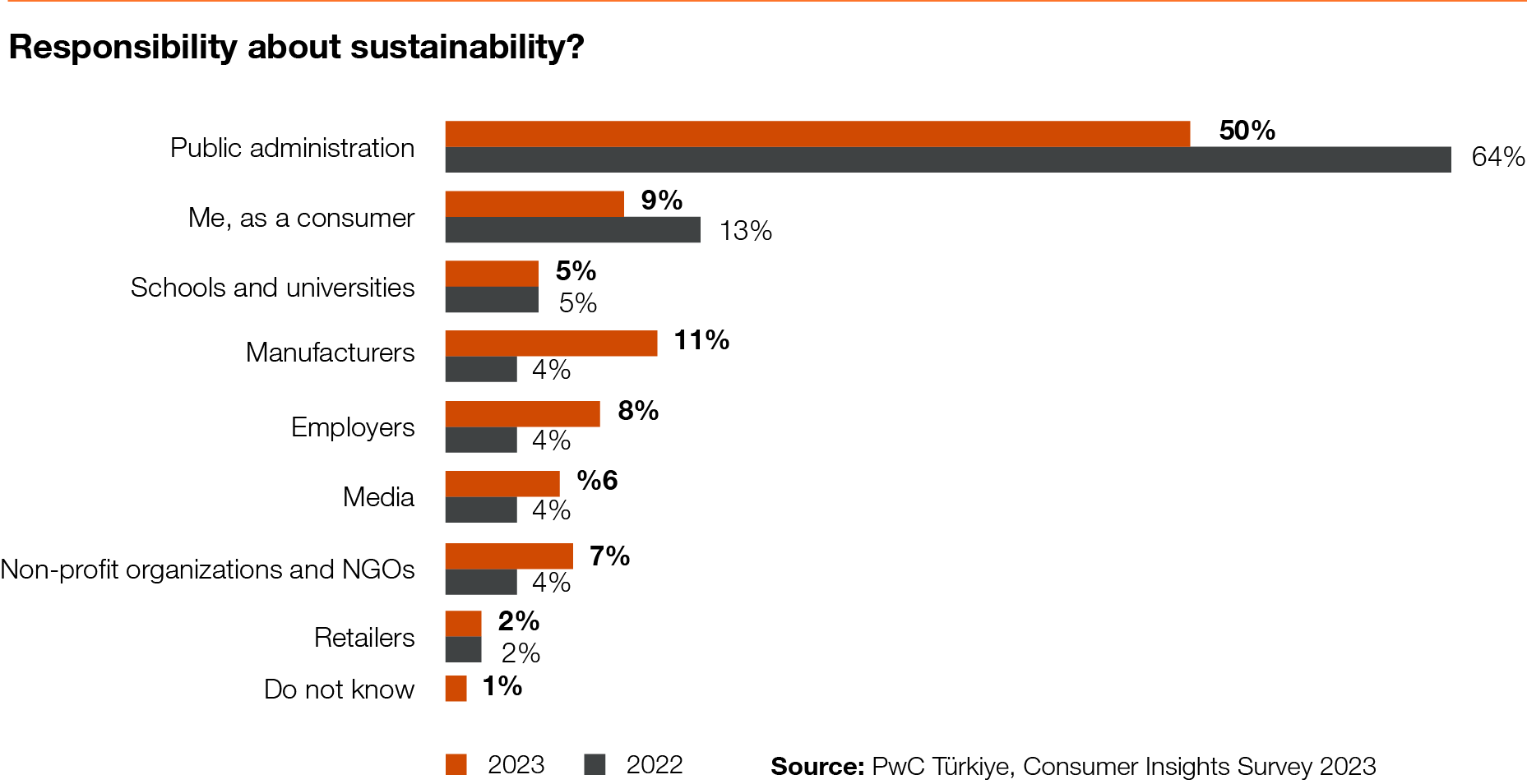

While consumers continue addressing public administration as the main responsible party for sustainability (50%), there’s a significant decrease compared to last year's survey (64%). The responsibility of the brands increases by 7 points, reaching 11%. Similarly, the responsibility of NGOs for sustainability is 6% more than last year (4%), meanwhile consumers withdraw their own share in this regard. Only 9% of consumers think they are responsible for sustainability, down 4 points from previous findings.

Conclusion

For growth efficiency and competitive advantage, understanding the consumer and keeping up with their change and development is crucial. 2023 has been a difficult year for the Turkish consumers. The economy is back on track - confirming with many indicators, meanwhile the earthquake disaster in February was one of the factors slowing down the positive momentum.

Consumer expectations regarding the economy improved with the conventional policies put into effect. However, in a landscape where economic pressures were felt especially in the shrinking credit market, the increasing expectation on the "speed" of product and service offerings became one of the outstanding "surprises"; a slow-paced approach is no longer an option.

The importance of interaction with consumers was one of the significant factors in our previous survey. The brands which do not "get to know" their customers have suffered a heavy damage in the market. In a competitive environment where artificial intelligence is the defining factor, building up diversified consumer experience via different channels without “customizing” them seems like an irreversible mistake.

In addition, young consumers are more aware of the world, this fact increases the importance they refer to sustainability and drives brands to take more responsibility regarding our future.

Methodology

The Consumer Behaviour Survey is prepared with the analysis and comments of PwC Türkiye industry consultants, based on the findings of the field research conducted with collaboration of PwC Türkiye and Ipsos.

The research was conducted with a sample representing the Turkish population, consisting of women and men,18+ age groups, AB, C1, C2 SES groups. The sample was distributed inline with the population age groups and male and female participants in half. The research data was gathered and processed from a total of 1,000 participants using the online data collection (CAWI) method in December 2023.

Contact Form

You can contact us to learn more about PwC solutions

Contact us